Exponential Moving Average in PythonMoving averages are essential indicators when we need to find the trend of a stock or share for a specific period. Moving averages critically analyse the time series; thus, they are accommodating for economists, traders, and analysts to get insights about the market trend, identify the key performers and support levels, and track any stock's past and future performance. Traders generally use moving averages at the entry and exit points and assist them in measuring trends, the strength of security in any transaction, and predicting the future trend of a stock. Moving averages are of mainly three types. They are Simple Moving Average (SMA), Weighted Moving Average (WMA), and the Exponential Moving Average (EMA). SMA is the most basic one. It simply finds the average of the m data points where m is the given period of MA. Weighted Moving Averages provide weights to the data points involved in the SMA. EMA is also the same as WMA, as both types add more weight to the current or the most recent data. EMA is a type of Weighted Moving Average. They give more weightage to the most recent data and hence track the performance of any stock over the given period. This makes these averages faster in reacting to the price changes in the given period. Here we will learn more about the EMA and how to implement it in Python. What Is the Exponential Moving Average?EMA provides a measure to find the average price of a stock. It gives more weight to the current data points. Compared to SMA, EMA reacts to recent price movements more quickly and gives all observations made throughout the time the same weight. Based on previous prices, the exponential moving average (EMA) is a technical indicator showing how a security's price is trending. Hence, EMAs are lag indicators that highlight the stock price pattern rather than forecasting future values. The following elements should be taken into account while determining the EMA in the stock market:

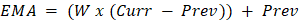

The formula for calculating the Exponential moving average (EMA) Following is the formula to calculate the EMA:  Steps to Calculate the EMAFollowing are the steps to calculate the EMA: Step 1 - Determine the simple moving average. Hence, if we wish to estimate the simple moving average for the previous ten days, add the latest ten values of the commodity and divide the total by 10. For examples - 1 + 2 + 3 + 4 + 5 + 6 + 7 + 8 + 9 + 10 / 10 = 5.5 Step 2 - Using the following formula, compute the weighting constant to be multiplied by the difference for the particular number of periods: EMA(current) = ((Price(current) - EMA (prev)) x Multiplier) + EMA(prev) Step 3 - Now that you have both the SMA and the constant multiplier values, you can use the formula to compute the EMA: (Closing price-EMA(previous day)) x multiplier + EMA(last day) In this case, the EMA utilizes the prior day's readings and combines all price data into its current value. The influence of previous prices on moving averages is negligible, but the impact of new prices is maximal.  Curr = Current Value Prev = Previous value of EMA W = Exponential weighting constant What Does the EMA Tell You?EMA calculations are a good option for calculating moving averages of 10, 15, 20, 50, 100, and 200 days.

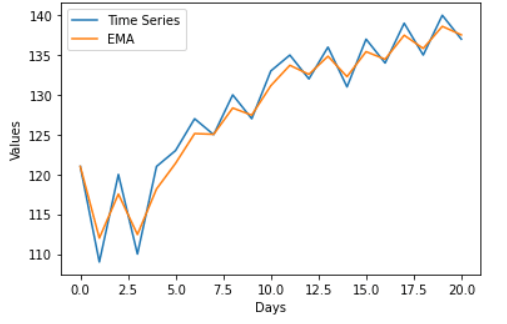

We will now see how to calculate Exponential Moving Average in Python EMA in PythonMethod 1We will not use any built-in library or function in this example. We will create our own algorithm to calculate EMA. We will create a small set of data values to use for reference. Code Output: The EMA values are: [121, 117.64, 118.3, 115.98, 117.39, 118.96, 121.21, 122.27, 124.43, 125.15, 127.35, 129.49, 130.19, 131.82, 131.59, 133.1, 133.35, 134.93, 134.95, 136.36, 136.54] Method 2In this example, we will use the emw function of the Pandas library to calculate EMA. Let us first see the syntax of this function. Syntax of the function Here com = 1 / (1 + K), where K is the smoothening factor used in the formula to calculate EMA. Example 1 We will calculate the EMA of our data values and plot the data and the moving average using the matplotlib library. Since the EMA is an average, it is the smoothened version of the actual time series data. We will take the com value as 2.5, which we have calculated for the K = 0.28. We can then compare the EMA values that we calculated using our algorithm and the EMA values calculated by the built-in ewm function. Code Output: EMA: Values 0 121.000000 1 114.000000 2 116.697248 3 114.110360 4 116.528432 5 118.660629 6 121.293028 7 122.429146 8 124.702267 9 125.382271 10 127.613872 11 129.762086 12 130.409649 13 132.021396 14 131.727681 15 133.241006 16 133.458575 17 135.045557 18 135.032519 19 136.453498 20 136.609775 We can see that the EMA values are close to those we calculated earlier. Hence this proves that the algorithm gives a reasonable estimation of EMA. Example 2 In this example, we will use the same time series we used in the previous example. However, we will see the effect on EMA after changing the com value. Code Output: EMA: Values 0 121.000000 1 114.333333 2 116.655738 3 114.401084 4 116.364112 5 118.162807 6 120.399265 7 121.504908 8 123.467316 9 124.258843 10 126.171358 11 128.067380 12 128.899659 13 130.385056 14 130.512530 15 131.847603 16 132.287999 17 133.655025 18 133.927954 19 135.156527 20 135.528654 Example 3 In this example, we will also use the same time series as before. Here we will give a different com value to the emw function. This time the value will be close to zero. We will see how such a small value will change the EMA calculation and will visualize it as we have done in the above cases. Code Output:  The Difference Between Exponential and Simple Moving Average

Limitations of the Exponential Moving Average

|